Mortgage Broker Scarborough - An Overview

Wiki Article

The Buzz on Mortgage Broker In Scarborough

Table of ContentsSome Of Scarborough Mortgage BrokerSome Ideas on Mortgage Broker In Scarborough You Should KnowWhat Does Mortgage Broker Scarborough Mean?Some Known Incorrect Statements About Scarborough Mortgage Broker All About Mortgage Broker Near MeSome Ideas on Mortgage Broker Near Me You Should Know

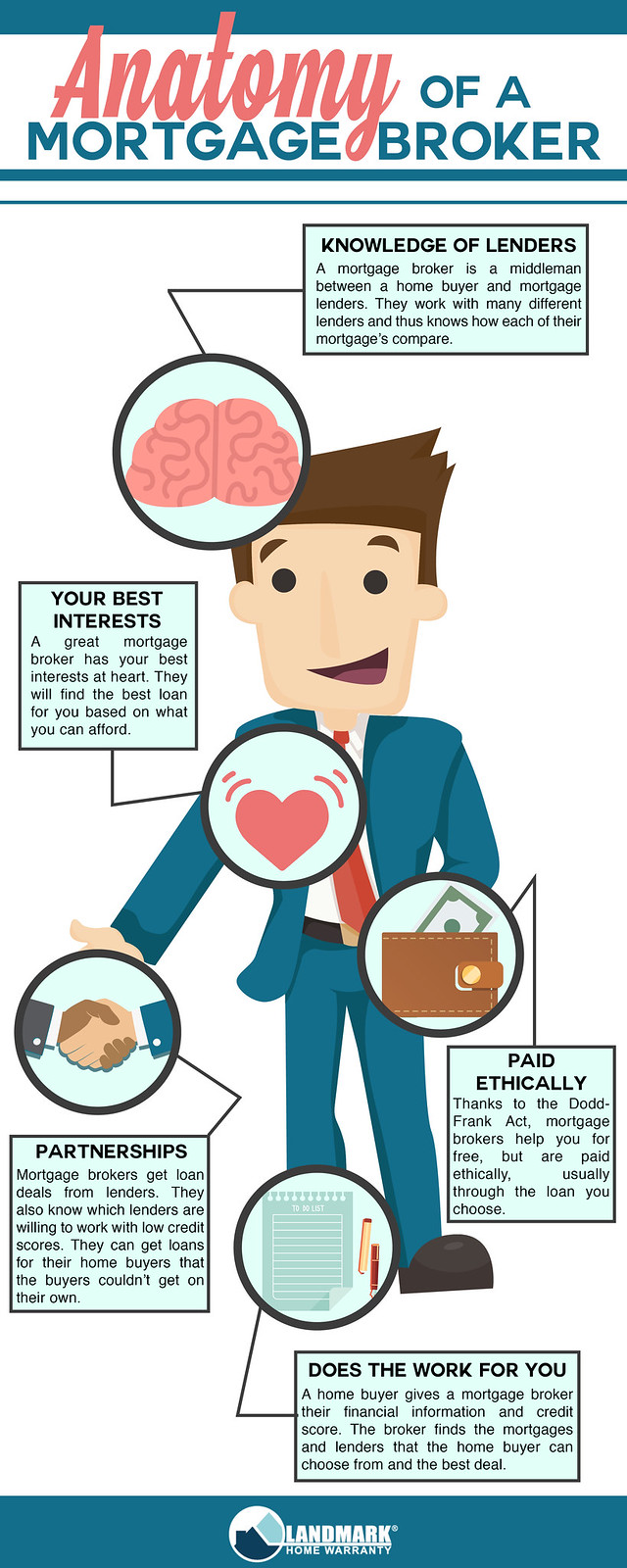

What Is a Mortgage Broker? A home mortgage broker is an intermediary between a financial institution that provides loans that are protected with realty and people thinking about purchasing realty who require to obtain cash in the type of a car loan to do so. The mortgage broker will certainly deal with both parties to obtain the specific accepted for the financing.A mortgage broker commonly works with lots of different lending institutions as well as can offer a variety of car loan choices to the customer they deal with. What Does a Home mortgage Broker Do? A mortgage broker intends to complete actual estate purchases as a third-party intermediary in between a consumer and also a lending institution. The broker will certainly gather details from the individual and also go to multiple lending institutions in order to locate the very best prospective funding for their customer.

The Base Line: Do I Required A Mortgage Broker? Dealing with a home mortgage broker can save the customer time and initiative during the application procedure, and potentially a great deal of cash over the life of the car loan. On top of that, some loan providers function specifically with home mortgage brokers, meaning that consumers would have accessibility to loans that would or else not be offered to them.

The Facts About Scarborough Mortgage Broker Uncovered

It's critical to check out all the costs, both those you may have to pay the broker, as well as any fees the broker can aid you stay clear of, when weighing the choice to collaborate with a home loan broker.

What is a home mortgage broker? A home mortgage broker acts as a middleman between you and potential lenders. Mortgage brokers have stables of loan providers they work with, which can make your life less complicated.

Mortgage Broker Near Me Things To Know Before You Get This

How does a home loan broker obtain paid? Home loan brokers are most typically paid by loan providers, in some cases by borrowers, yet, by click here to read law, never ever both.

Home mortgage brokers may be able to give borrowers accessibility to a broad option of financing types. 4. Is a mortgage broker right for me? You can conserve time by utilizing a home loan broker; it can take hrs to make an application for preapproval with various lenders, after that there's the back-and-forth interaction associated with financing the financing as well as ensuring the purchase remains on track.

Mortgage Broker In Scarborough Can Be Fun For Anyone

When picking any kind of loan provider whether through a broker or directly you'll desire to discover here pay attention to lending institution fees." Then, take the Finance Quote you obtain from each lending institution, put them side by side as well as compare your rate of interest price and all of the costs and also shutting expenses.5. mortgage broker near me. How do I pick a mortgage broker? The ideal means is to ask buddies and also relatives for referrals, but see to it they have really used the broker and also aren't just going down the name of a former university flatmate or a remote acquaintance. Find out all you can regarding the broker's solutions, communication design, degree of understanding and approach to customers.

Ask your representative for the names of a few brokers that they have functioned with and trust. Some actual estate firms offer an in-house home loan broker as part of their collection of services, however you're not obliged to go with that firm or person.

A Biased View of Mortgage Broker

Also, review online reviews as well as get in touch with the Better Organization Bureau to analyze whether the broker you're considering has an audio credibility. Frequently asked inquiries, What does a mortgage broker do? A mortgage broker locates lenders with loans, rates, and terms to fit your requirements. They do a great deal of the research during the mortgage application procedure, possibly saving you time.

Competition and home prices will certainly affect just how much home mortgage brokers get paid. What's the difference between a mortgage broker and a lending officer? Home loan brokers will helpful hints certainly deal with numerous lending institutions to locate the finest funding for your scenario. Financing officers help one loan provider. Exactly how do I locate a mortgage broker? The very best means to find a home mortgage broker is with recommendations from household, good friends as well as your real estate agent.

Buying a brand-new residence is just one of one of the most intricate occasions in an individual's life. Characteristic differ greatly in terms of style, features, institution district and, of course, the constantly vital "location, place, place." The home mortgage application process is a complex aspect of the homebuying process, especially for those without past experience - mortgage broker.

Not known Details About Scarborough Mortgage Broker

Report this wiki page